1991 by the Fourth Session of the 7th National Peoples Congress NPC 30 Jun. Expenses that were not incurred in the production of profits.

Avoiding Rental Pitfalls The Star

For example include wages from Form 1040 or 1040-SR line 1 Income is earned in the tax year you perform the services for which you receive the pay.

. Traders can also deduct asset depreciation wear and tear from their taxable. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. If you are a cash basis taxpayer include in income on Form 1040 or 1040-SR the foreign earned income you received during the tax year regardless of when you earned it.

But if you are a cash. In tax terms the closing price is the basis Value of Land - Estimate the value of the land. For capital assets such as machinery you may be entitled to an income tax deduction for the assets decline in value depreciation.

Tax rebate for self. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

However it will not apply to investment income. Therefore local forex traders should keep records of all expenses related to their trading activities including staff remuneration forex trading courses money spent on trading software office equipment stationery office rental cleaning services computer repairs bank fees etc. In general expenses incurred for the production of business income are tax deductible.

Such income shall be taxed separately from an investors income eg. The applicable tax rates shall be 20 for the income tax base of up to KRW 300 million and 25 for the excess. Worldwide rental income from the letting of private property is normally considered as capital income.

Most of the property. Purchase Price - The closing price or contract price of the rental property. Employment income interest on bank deposits dividends subject to annual income tax return filing capital gains and retirement income.

Tax is assessed on annual rentals and other income received from the real property after deduction of related expenses. The estimated value gets deducted from the Adjusted Basis Per IRS Publication 527 Residential Rental Property 2016 p6 Certain property cannot be depreciatedThis includes land and certain excepted. Income Tax Law of the Peoples Republic of China on Enterprises with Foreign Investment and Foreign Enterprises Detailed Rules for Its Implementation.

For private property house the related expenses are deemed to amount to a standard amount of SEK 40000 and 20 of the. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Note that if you work for a Thai company with an International Business Center IBC status have a tax-residency status in Thailand make a.

As you mightve noticed tax rates are comparable to most other countries so the assumption that Thailand is a tax haven is untrue. Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset or a non-business asset and the length. 1991 by State Council 1 Jul.

However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible. Tax rebate for. That is when working out the decline in value use the cost of the asset less any GST credits youre entitled to.

The cost of an asset that you can depreciate is reduced by the amount of any GST credit that you are entitled to. Individual Income Tax Law of the Peoples Republic of China Regulations for Its Implementation. The main source of personal income tax for expats in Thailand is through employment.

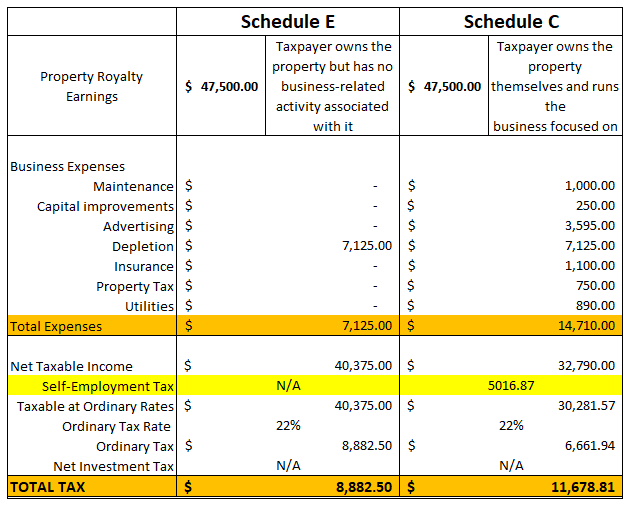

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

Airbnb Rental Income Statement Tracker Monthly Annual Etsy

Quick Overview Of Czech Real Estate Rsm Cz

Top 6 Countries For Day Traders Social Media Statistics Social Media Infographic Social Media Stats

Airbnb And Rental Income Statement Tracker Rental Property Etsy New Zealand

Provision For Income Tax Definition Formula Calculation Examples

Rental Income Expense Worksheet Rental Property Management Real Estate Investing Rental Property Rental Income

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties In 2022 Being A Landlord Rental Property Management Rental Income

15 Tax Deductions You Should Know E Filing Guidance Tax Forms Income Tax Tax Deductions

Rental Property Owner S Tax Guide Self Assessment For Ireland

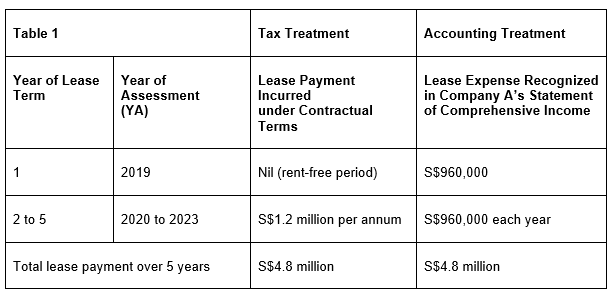

Tax Treatment For Rental Of Business Premises Crowe Singapore

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Rental Income Airbnb Rentals Being A Landlord

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Ledger To Record The Payments And Balances Owed For More Up To Twelve Tenants Free To Downl Being A Landlord Apartment Management Small Business Plan Template

Global Rental Income Tax Comparison

M Sian Landlords May Not Need To Declare Tax On Asklegal My